Fortnox is a Swedish company quoted on the Stockholm exchange, engaging in the business of offering products, packages, solutions, and integrations to cover businesses' financial and administrative needs by creating easy flows in accounting, invoicing, financing, and managing employees. It operates through the following segments: Businesses, Accounting Firms, Core Products, Financial Services, and Marketplaces. The Businesses segment offers products and services to non-accounting firms. The Accounting Firms segment caters to accounting firms. The Core Products segment is involved in the product development and user support for services in financial administration. The Financial Services segment provides product development, user support, and sales to existing customers for payment and financial services. The Marketplaces segment consists of product development, user support, and sales of intermediation services and products. The company was founded by Jens Collskog and Jan Fortnox in 2001 and is headquartered in Vaxjo, Sweden.

Data Table:

Coompiled from tradingview.com

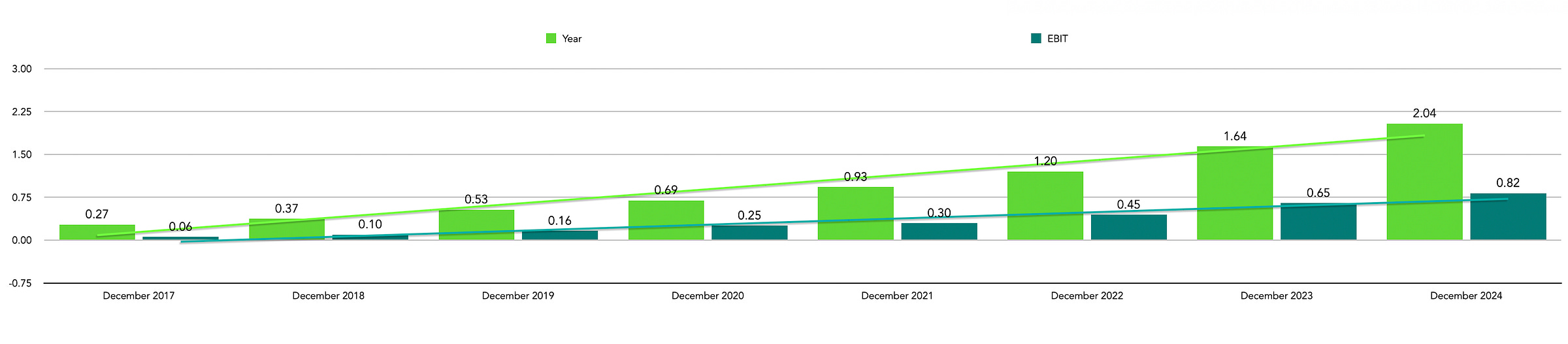

Turnover to EBIT

Full year 2024 earnings: EPS exceeds analyst expectations

Full year 2024 results:

EPS: kr1.17 (up from kr0.94 in FY 2023).

Revenue: kr2.10b (up 28% from FY 2023).

Net income: kr710.0m (up 25% from FY 2023).

Profit margin: 34% (in line with FY 2023).

Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 2.4%.

Revenue is forecast to grow 17% p.a. on average during the next 3 years, compared to a 15% growth forecast for the Software industry in Sweden.

Over the last 3 years on average, earnings per share has increased by 37% per year but the company’s share price has only increased by 26% per year, which means it is significantly lagging earnings growth. Source: Simply Wall Street

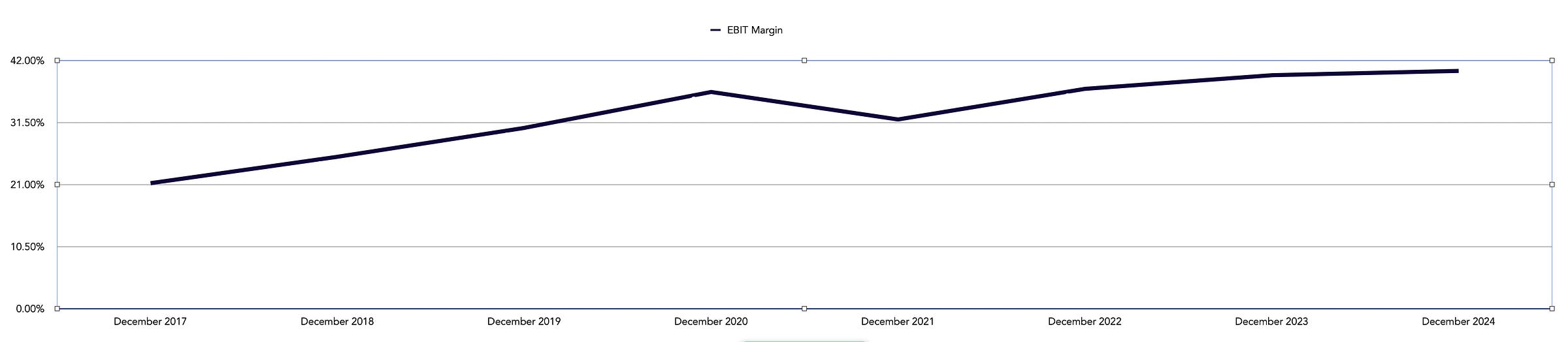

EBIT Margin

A consistently healthy margin

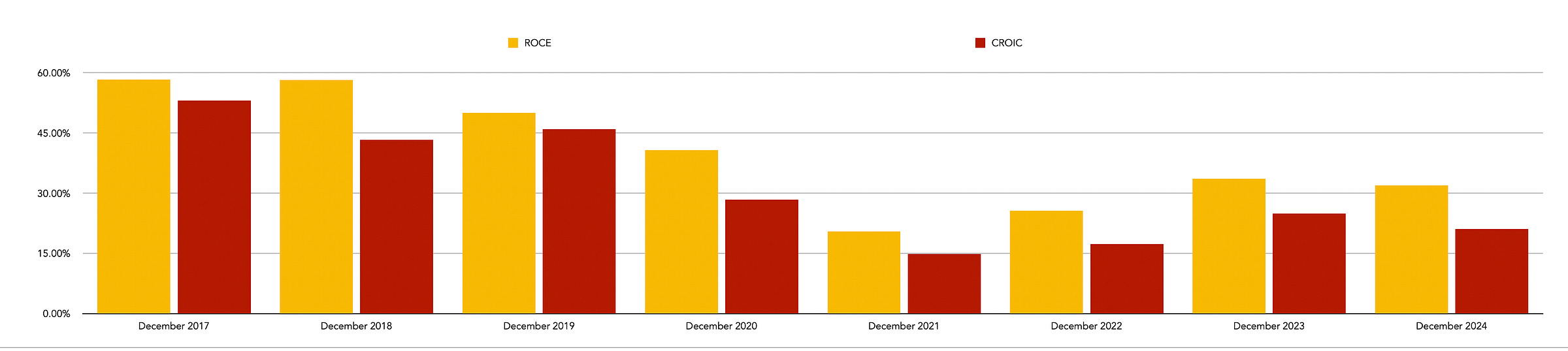

Returns on Capital

You will have noticed the the drop in ROCE in recent years. My take is the company has been expanding in recent years and last year it took on more staff.

I am happy with this explanation as the returns on capital are still high, however I will still keep an eye on them in case of long term deterioration.

Free cash Flow to Dividends

Dividends are securely covered by free cash flow.

Debt to Equity 0%

Intrinsic Value

Simply Wall Street suggests that Fortnox is valued about right at SEK 74.29 against its market price of SEK 75.20.

My intrinsic value dividend calculator suggests a value of SEK 110.05

The above Ratio’s and intrinsic values are only worth something if the company can keep some form of growth. Simplywallstreet “Fortnox is forecast to grow earnings and revenue by 23% and 17.1% per annum respectively. EPS is expected to grow by 22.9% per annum. Return on equity is forecast to be 31.2% in 3 years”

Watchlist:

The prices in the watchlist are those at the date of publication and may changed since then.