Welcome to another company review, this time Idexx Laboratories a company that has very enticing returns on capital.

IDEXX Laboratories, Inc. develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally. The company operates through three segments: Companion Animal Group; Water Quality Products; and Livestock, Poultry and Dairy. It offers in-clinic chemistry, blood and urine chemistry, hematology, immunoassay, urinalysis, cytology, and coagulation analyzers; and SNAP rapid assays test kits.

The company also provides commercial reference laboratory diagnostic and consulting services to veterinarians; veterinary consultation, telemedicine, and advisory services, including radiology, dental radiography, cardiology, internal medicine, and ultrasound consulting; Colilert, Colilert-18, and Colisure tests, which detect the presence of total coliforms and E. coli in water; Enterolert, Pseudalert, Filta-Max and Filta-Max xpress, Legiolert, Quanti-Tray products, and Tecta system instruments; and veterinary software and services for independent veterinary clinics and corporate groups. In addition, it offers diagnostic tests, services, and related instrumentation for manage the health status of livestock and poultry; human medical diagnostic products and services; and VetConnect PLUS, a cloud-based technology that enables veterinarians to access and analyze patients, as well as operates VetLab Station. The company markets its products through marketing, customer service, sales, and technical service groups, as well as through independent distributors and other resellers. IDEXX Laboratories, Inc. was incorporated in 1983 and is headquartered in Westbrook, Maine.

Provided by Simply Wall Street

Data Table compiled from tradingview.com

Turnover to EBIT

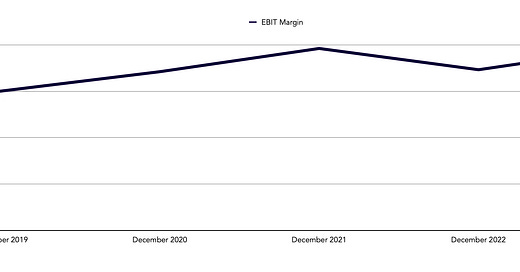

EBIT Margin

Capital Returns

Free Cash Flow

Main points

Tunover

From the 4th QTR report the company give the following initial 2025 guidence.

The Company's initial 2025 revenue guidance range reflects full year growth of 4% - 7% as reported and 6% - 9% on an organic basis, supported by 3% - 6% reported and 5% - 8% organic CAG Diagnostics recurring revenue growth. The guidance range for global CAG Diagnostics recurring revenue growth reflects goals for sustained benefits from execution drivers, supporting continued solid volume gains, and an estimated 4% - 4.5% full year benefit from net price improvement. 2025 EPS guidance of $11.74 - $12.24 reflects expectations for solid organic revenue gains and a targeted 200 - 250 basis points of reported operating margin improvement, including a ~160 basis point benefit from lapping the 2024 discrete litigation expense accrual.

EBIT .Excelent margins range from 22% to 30%

ROCE and CROIC. ROCE consistently around 52%. ROIC around 35%

Free Cash Flow compared to Dividends. Steadily increasing cash flow, but unfortunately there are no dividends at present

Debt to Equity. At 54.4% but interest payments are covered 64.3 times by EBIT.

On 30th September 2022 Debt to Equity was 292.8% so you can see the impact of the cash generation to reduce this to current levels.

I consider IDEXX an ideal company to go into my Watchlist which I will post updates for explaining the removal of two companies.