March 2025 Capital Performance

The Office of National Statistics announced the latest inflation figures end March. Of course the Press and Politicians take note that inflation is 2.6%. They look at the Consumer Prices Index. A more encompassing statistic that reflects real life is the CPIH. The same as the first but including housing this was 3.4% increase from March 2024.

An investor at the least must beat inflation in order to keep the value of his money and hopefully a little bit more.

I compare my performance to indices of different mediums. I compare these on an annualised basis starting from prices at the 26th May 2021. The hardest job recently is finding reliable sources of data and for now Yahoo Finance seems to be the most reliable source with detailed historical prices.

So lets compare.

The S&P 500 ended 5611.85 down from 5954.50 down 5.76% on the month.

The Vanguard FTSE Global All Cap Fund ended at 217.35 down from 231.51 for a 6.11% fall.

The FTSE All Share 500 ended 4671.27 down from 4754.32. A 1.74% fall.

Gold. I’ve changed again the source for gold prices, both current and historical using information from GoldPrice.org. Gold ended at 3089.58 up from 2876.03 in Feb. That’s a 7.42% increase.

Bitcoin ended March at $82548.91 down from $84373.01 for a 2.16% fall.

Lastly the ISA portfolio completed a bad month finishing March at £225114.90 down from February’s £244032.00 for a fall of 7.75%.

Impressive results from Bitcoin, for me its like gold in that it doesn’t produce any income and I wouldn’t know how to go about valuing it.

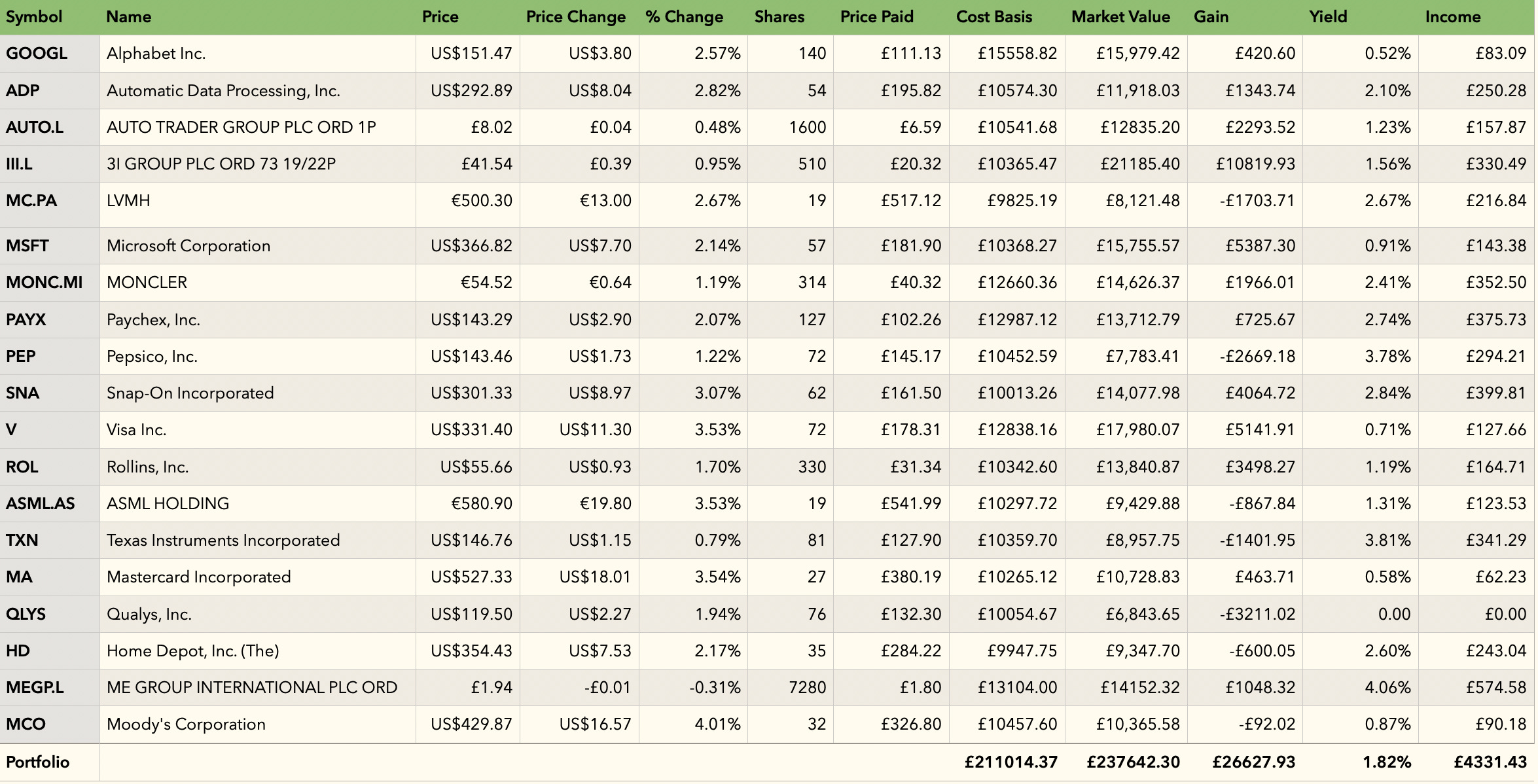

Current Portfolio

I am pleased with the holdings and they continue to provide a hedge against inflation. I pay attention to the latest updates of the companies I hold from SimplyWall Street and they are encouraging.

Two obvious buys from this list are Pepsico and Qualys.