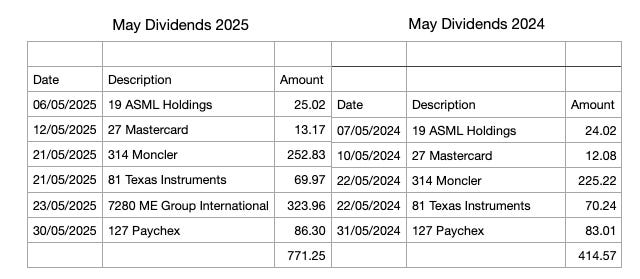

The dividends for last month have been enhanced considerably by the contribution of ME Group International. The company was previously the boring old Photo-Me and changed it name to reflect its move beyond photo booths into Self-Service, laundry vending (Revolution Laundry) and food vending machines, thus broadening its revenue streams.

Without the ME Group’s contribution how would the like for like dividend growth be?

I am happy with increase of 7.89%. increase.

A problem I’ve been thinking about.

With the contributions of this month I have a cash position of £1005.91. Last year when I reached a £1000 I bought shares, ME Group International as it happens. The problem is that I would like the dividends to bump up a bit, but thats not going happen with a “Quality” approach as the dividends are notoriously lower compared to other share selection methods.

I didn’t want to abandon my quality approach either, as I’m fed up of purchasing companies that only go on to struggle after professional recommendations.

So my compromise is to invest accumulated dividends when they reach £2000 in companies that may be classed as dividend growth companies. My first port of call to see if Phil Oakley has anything to say and low and behold he has written several articles, but I’m choosing the one that most resembles the methods I use at the moment.

The criteria will be a minimum starting yield of 3%

Minimum dividend cover of 1.5 times

Dividend years of growth at least 5 years

A minimum return on capital employed of 10%

A minimum growth rate of 2%, but greater than inflation.

Personally I think the above standards are tough and may have to amended, but I do like the return on capital element.

A link below will take you to Phil Oakley’s article.

https://knowledge.sharescope.co.uk/2015/10/04/chapter-11-dividend-investing/