QUALCOMM Incorporated engages in the development and commercialisation of foundational technologies for the wireless industry worldwide. It operates through three segments: Qualcomm CDMA Technologies (QCT); Qualcomm Technology Licensing (QTL); and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software with advanced connectivity and high-performance, and low-power computing technologies for use in mobile devices; automotive systems for connectivity, digital cockpit, and ADAS/AD; and IoT, including consumer electronic devices, industrial devices, and edge networking products.

The QTL segment grants licenses or provides rights to use portions of its intellectual property portfolio, which include various patent rights useful in the manufacture and sale of wireless products comprising products implementing CDMA2000, WCDMA, LTE and/or OFDMA-based 5G products. The QSI segment invests in early-stage companies in various industries, including 5G, artificial intelligence, automotive, consumer, enterprise, cloud, IoT, and extended reality, and investments, including non-marketable equity securities and, to a lesser extent, marketable equity securities, and convertible debt instruments. It also provides development, and other services and sells related products to the United States government agencies and their contractors. The company was incorporated in 1985 and is headquartered in San Diego, California. Provided by SimplyWallstreet

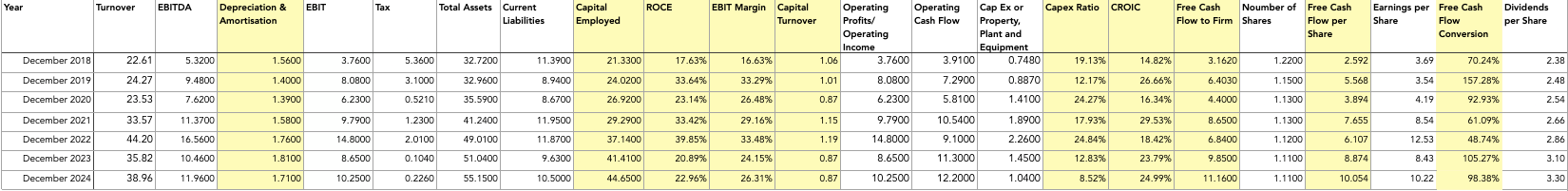

Data Table. Data from tradingview.com

Revenue breakdown by Country

China 45.7%, United States 24.86%, South Korea 20.52%, Rest of the World 8.87%

Turnover compared to EBIT

EBIT Margin

ROCE and CROIC

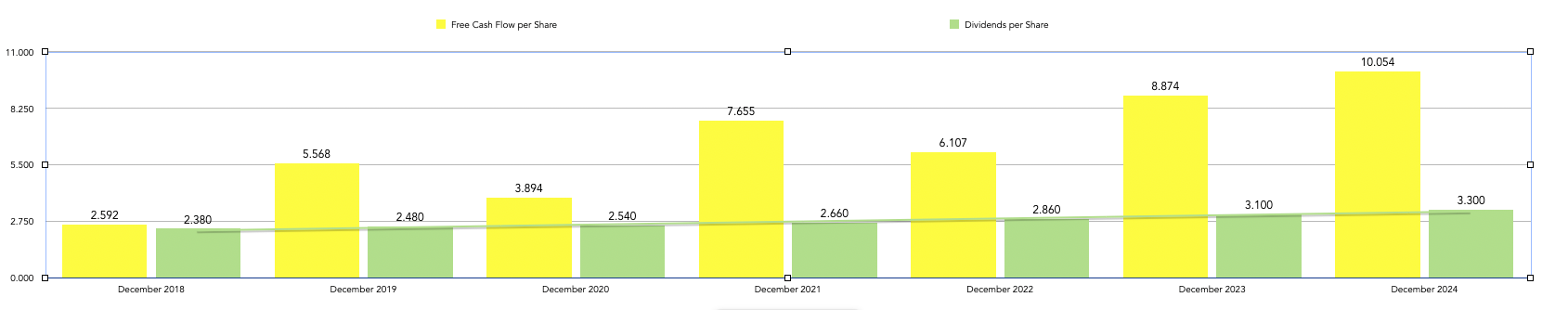

Free Cash Flow and Dividends

Why Has Qualcomm Stock Fallen

Qualcomm stock has fallen despite reporting strong earnings and issuing an encouraging outlook. The drop can be attributed to disappointing licensing revenue of $1.54 billion, which was slightly below Wall Street's expectations. Additionally, concerns about Qualcomm's exposure to the mobile market, with its diminishing growth and increasing competition, have also contributed to the stock's decline. Some analysts believe the company needs to diversify into more profitable markets to alleviate pressure on the stock price.

Furthermore, there are near-term headwinds for Qualcomm, including growing exposure to China, macroeconomic concerns in the U.S., and Apple's push into the mobile modem space, which could potentially reduce Qualcomm's revenue and margins. These factors have raised concerns among investors and could lead to further declines in the stock price.

Despite these challenges, Qualcomm has seen strong performances from its key business units, and the company's top-line performance has been driven by revenues of $10.1 billion from its QCT (Qualcomm CDMA Technologies) segment. Qualcomm's stock has also shown resilience during previous market downturns, recovering from significant declines in the past.

The current median target price for QUALCOMM stock is $173.11, with a high estimate of $250.00 and a low estimate of $100.00, indicating a range of potential outcomes for the stock price based on analysts' forecasts. 234

A very neat AI generated answer. The latest quarter from the company shows the company to tackling these concerns

"We are pleased to report another quarter of strong results,” said Cristiano Amon, President and CEO of Qualcomm Incorporated. “As we navigate the current macroeconomic and trade environment, we remain focused on the critical factors we can control – our leading technology roadmap, best-in-class product portfolio, strong customer relationships and operational efficiencies. Our top priorities remain executing our diversification strategy and continuing to invest in areas that drive long-term value.

Recap

EBIT margins consistently in the 25% region

ROCE and CROIC around 20%

Free Cash Flow and Dividends. Dividends are well covered by an increasing cash flow

Debt to Equity a comfortable 52.7%

Interest Coverage. Qualcomm earns more interest than it pays so this is not a concern

Analysts estimate Revenue and Earnings growth over the next couple of years ar going to be modest 2.2% and 2.8% growth over the next two years.

At a yield of 2.4% I am looking forward to buying a holding when funds permit. I the meantime I am adding the company to my Watchlist.

Watchlist Review

I am removing Alpha International. there is nothing wrong with the company’s performance but I just don’t like financial businesses. Alpha provides foreign exchange services so it might be a little bit different, but its not for me.

Fortnox AB has received a bid and its disappointing that the management has accepted the offer without trying to prise a higher price for the shareholders.

Infosys is marked orange as it appears overvalued, but it its 4% dividend yield suggests its good value.

Green indicates potential buys.