I have recently received the Substack Kroker Equity Research e-mail and thought it would be a topic worth writing about.

For those who don’t know, Kroker writes a thorough analysis of stocks he is interested in and I would encourage a subscription to his work. I am on the free tariff and the paid is $39 a year. I have looked at many others who charge a couple of hundred or more and by and large I wouldn’t take a free subscription.

In the post Kroker looks at three companies. They are Boot Barn Holdings, Vital Farms Inc, and Fitlife Brands Inc from the “Three Under The Radar US Small Caps” post. For this exercise I will be using SimplyWallStreet and I am looking at three ratios a net profit margin around 15%, a Return on Capital Employed around the high 20% region and of course a Debt to Equity, the lower the better.

Boot Barn Holdings

A low Net profit Margin

A Low Return on Capital Employed

In summary this is a business whoose margins are too low for my interest although it hasn’t any debt.

Vital farms Inc

A Low Profit Margin, but know Debt

A Return on Capital Employed on the low side. I might consider it if the company paid a dividend. So i am excluding it.

Fitlife brands

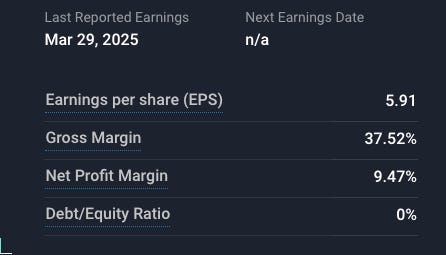

A Net profit margin close to my 15% and a low Debt to Equity ratio

A Return on Capital Employed in my ball park area. The company doesn’t pay a dividend but will go into my next Watchlist article. This process take a few minutes on a mobile phone and then can be chosen for a Watchlist article, checking the company accounts and reading the full deep dive from Kroker.

I wish you profitable investing.